USDA Loans

USDA loan is special type of a zero down payment mortgage that eligible homebuyers in rural and suburban areas can get through the USDA Loan Program

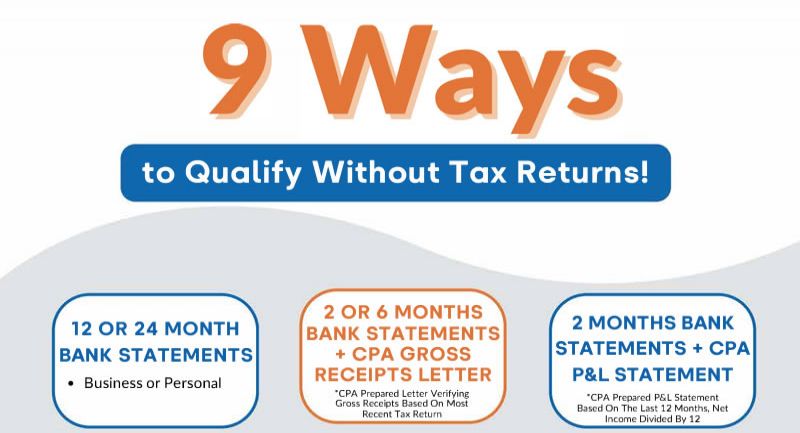

We understand that every borrower is different and we are committed to helping you find the right mortgage product for your needs.

EDGEWATER Residential Capital offers a variety of products from the most competitive lenders to meet your individual requirements. We specialize in Conventional, Jumbo, Super Jumbo, ARMS, VA, Refinance FHA, USDA loans and we offer 100% financing on USDA and VA loans.

Before you begin the process of applying for a mortgage, you may want to learn a little more about the different ways of finding a home loan. While some borrowers opt to work with the lenders at their bank or get financing through large mortgage companies, many other borrowers choose to work with mortgage brokers, instead.

We service the greater Lake Norman area including Mooresville, Davidson, Cornelius, Huntersville, Charlotte, and Mecklenburg County.

North Carolina and South Carolina’s #1 solution for mortgage loans. Our mortgage brokers in the Carolina’s are working hard to get you qualified and approved for your dream home!

NC and SC Mortgage Broker Makes It Easy To Get Approved For a Mortgage Loan.

Edgewater Residential Capital is connected to a nationwide mortgage lender network, offering prospective buyers access to conventional, FHA, VA, and USDA loan programs. We also connect buyers with down payment assistance programs and provide guidance on first-time home purchasing and loan refinancing.

It is finally time to own your own home in the Carolina’s beautiful scenic beaches and mountains and safe neighborhoods. Our loan programs for first time homebuyers in NC & SC make it easy to afford your down payment and move into a new home now.

We service North & South Carolina located in the Lake Norman area including Statesville, Mooresville, Davidson, Cornelius, Huntersville, Charlotte, and Mecklenburg County.

USDA loan is special type of a zero down payment mortgage that eligible homebuyers in rural and suburban areas can get through the USDA Loan Program

Conventional loans to 95% loan-to-value (LTV) – not us. A 97% LTV is just one of the things that make Newrez’s conventional loans a better choice

Big Jumbo loan gives your customers the ability to borrow more than the traditional loan amounts with a lower down payment requirement.

An adjustable-rate mortgage (ARM) is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan.

The Federal Housing Administration and the Department of Veterans Affairs have increased loan limits - meaning you can now finance more

Refinancing is the replacement of an existing debt obligation with another debt obligation under different terms.